Report Finds Agricultural Finance Model Created by Heifer International and Hello Tractor Profitable, Effective

By Muthoni Ngure | August 26, 2025

November 25, 2025

Women grow much of Africa’s food but receive less than 10 percent of the credit that fuels its production. This imbalance limits productivity, reduces household income and leaves families more exposed to food insecurity.

Women cultivate the land but remain both financially and digitally excluded. Many lack access to data, tools and digital records that determine who qualifies for credit, insurance or investment. Their contributions often go unrecognized, and their potential is underfunded. Closing this gap is one of the most practical ways to strengthen agricultural value chains and build a more inclusive and resilient food system across Africa.

Across rural Africa, barriers such as limited collateral, restrictive social norms and distance from financial institutions continue to restrict women’s access to finance. But behind these familiar challenges lies an overlooked opportunity, the potential of digital financial services to expand access, build confidence and give women greater control over their resources.

Over the past decade, Africa has become a global leader in digital payments. According to the GSMA Mobile Money Report 2024, the continent now accounts for about 65 percent of the world’s mobile money transaction value and nearly three-quarters of all transactions.

Still, women remain underrepresented in the digital economy. Across sub-Saharan Africa, they are about 12 percentage points less likely than men to own a financial account. Closing this gap is one of the most effective ways to boost agricultural productivity and rural incomes. As climate shocks intensify and financing options remain limited, the digital divide risks deepening inequality, leaving millions of women farmers without the tools they need to manage risk and adapt to change.

Digital finance, ranging from mobile money and savings wallets to digital credit, reduces the need for collateral, cuts transaction costs and gives rural women the flexibility and privacy to manage their finances with confidence. Beyond individual gains, digital inclusion strengthens entire agricultural value chains. When women can pay suppliers, receive farm payments and save or borrow through secure digital platforms, cooperatives and agribusinesses become more efficient, transparency increases, and trust deepens across the system.

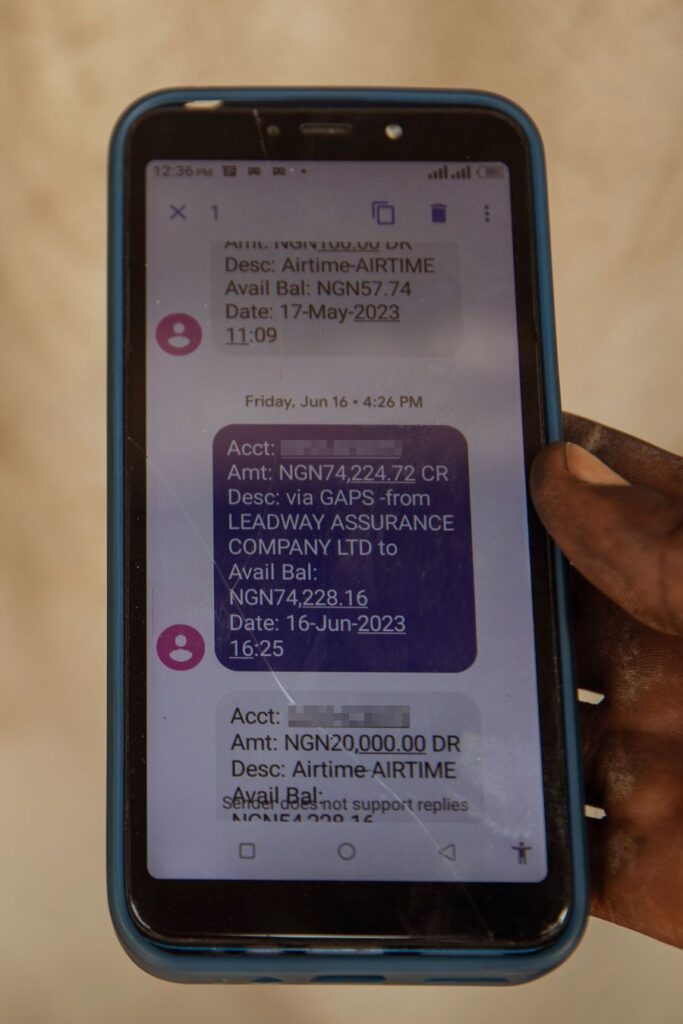

In communities supported by Heifer International, digital finance is already driving measurable change:

These experiences show that when digital tools are designed to meet women’s needs, they enhance livelihoods, strengthen cooperatives and boost local economies.

Digital finance is more than a gender or technology issue; it is a cornerstone of climate resilience. Women smallholder farmers are on the front lines of climate change, making daily decisions about when to plant, what to harvest and how to adapt to shifting weather patterns. Gender-responsive climate finance recognizes that investing in women’s access to capital, data and digital tools is among the most effective ways to build adaptive and resilient food systems.

When a woman can use digital credit to buy drought-tolerant seeds, insure her harvest or install solar irrigation, she becomes an active driver of adaptation rather than a victim of crisis.

Each dollar of climate finance that reaches her strengthens families, improves nutrition and reinforces the stability of local food systems.

True inclusion requires a systemic shift, from scattered pilot projects to national systems and policies that embed equity across the financing chain. From global investors to local cooperatives, every link in the capital value chain must intentionally include women as active participants and decision makers.

Achieving this requires a coordinated, multi-level approach:

When inclusion is built into every level of the system, finance stops leaking through exclusion and starts growing opportunity.

Africa’s governments are calling for finance that reaches the people working closest to the land. Yet if funds continue to move only through traditional channels, they risk bypassing the women who are integral to sustaining the continent’s food systems.

Gender-smart digital finance offers a practical way to direct resources where they are most needed, making capital flows transparent, inclusive and accountable. By connecting global finance to the first mile, it ensures adaptation funding reaches women farmers leading change on the ground.

Governments can reinforce this shift by embedding digital inclusion into National Adaptation Plans and climate finance frameworks, treating every digital wallet or credit line extended to a woman farmer as an investment in long-term resilience.

Digital finance is about unlocking opportunity. When women farmers can borrow, save and trade digitally, they strengthen households, grow local markets and expand Africa’s capacity to adapt to climate change.

The challenge now is scale, reaching more women, faster, and ensuring they are fully included in the digital economy. Gender, climate and finance are not separate priorities; they are parts of the same system. When they move together, Africa’s food systems become stronger and more resilient.

Originally published in PanAfrican Agriculture on Nov. 19, 2025.

Cart is empty

Success!

Please be patient while we send you to a confirmation page.

We are unable to process your request. Please try again, or view common solutions on our help page. You can also contact our Donor Services team at 855.9HUNGER (855.948.6437).

Covering the transaction fee helps offset processing and administrative fees that we incur through taking payments online. Covering the transaction fee for each payment helps offset processing and administrative fees that we incur through taking payments online. Covering the transaction fee for each payment helps offset processing and administrative fees that we incur through taking payments online.

Success!

Please be patient while we send you to a confirmation page.

We are unable to process your request. Please try again, or view common solutions on our help page. You can also contact our Donor Services team at 855.9HUNGER (855.948.6437).

When you donate a gift to someone, you'll have the option to create a free card after your donation is complete.

A FREE gift will be sent to supporters who choose to give a monthly gift.

Covering the transaction fee helps offset processing and administrative fees that we incur through taking payments online. Covering the transaction fee for each payment helps offset processing and administrative fees that we incur through taking payments online. Covering the transaction fee for each payment helps offset processing and administrative fees that we incur through taking payments online.

A FREE gift will be sent to supporters who choose to give a monthly gift.