How Financial Inclusion Reduces Poverty and Income Inequality

By Heifer International | December 30, 2023

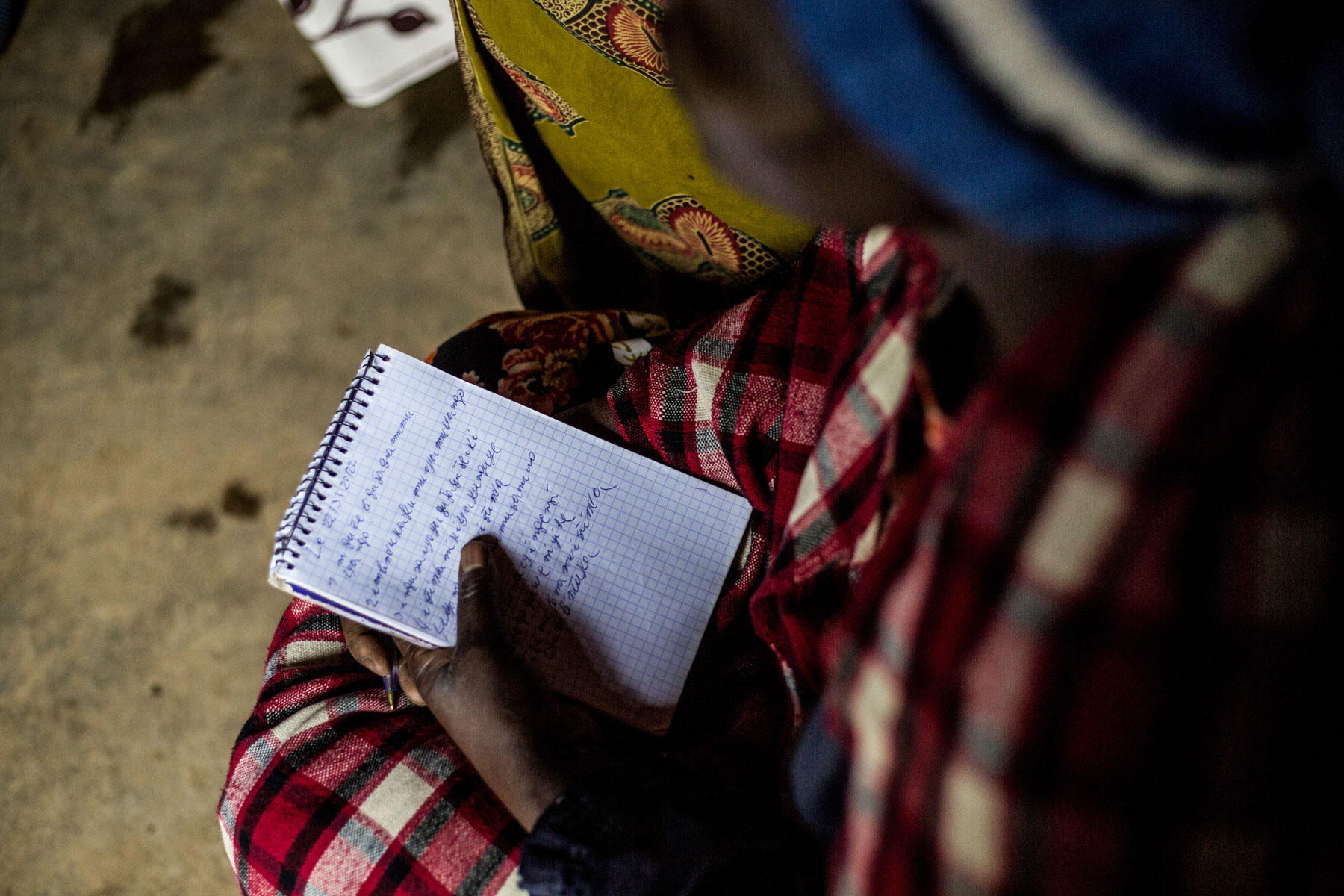

Thursdays are for doing business for the Abihuje farmers’ group. Since 2018, Vestine Icyimanizanye and the 29 other women members have been meeting weekly to support their work together in Bugeshi, Rwanda, including growing crops, establishing shared goals, expanding their farms and, most notably, saving money.

As the group’s success has grown so, too, has their savings: Each woman’s weekly contribution has more than doubled, from around 11 to 24 cents, an impressive expansion of the group fund that provides loans and emergency financial support to its members as needed. In just four years this fund has opened once-closed doors for Vestine and the all-women group, allowing them to borrow money to purchase land, livestock and other assets to support their families.

“Coming together as women, saving together and borrowing to expand our economic activities or solve other problems was the basis for a transformational journey,” said Vestine, who individually has taken several small loans to expand her farm and provide for her children.

And this impact isn’t isolated to one community in Rwanda. Savings and loans just like the funds Vestine manages with her group can unlock opportunity and improve lives for vulnerable farmers around the world, especially women. The true wealth of change, however, comes when it’s made available.

The Global Outlook

The world has made remarkable progress in financial access in the past decade. Between 2011 and 2021, adult account ownership jumped from 51 percent to 76 percent — a 50 percent increase, according to the World Bank’s Global Findex. By 2024, that share had risen again, with nearly 8 in 10 adults worldwide holding an account at a bank or financial institution.

Financial access, such as having a basic savings account, is important because it supports families’ day-to-day living and helps them plan for the future, including preparing for unexpected costs or saving for business needs, like tools and equipment. Yet, 1.3 billion adults remain unbanked, with women less likely than men to have their name on an account.

Faced with barriers like lack of money, unreasonable distance to a bank branch or insufficient documentation, it can be especially challenging for the rural poor to start a formal bank account from which they can build a secure life for their families.

“Almost everything was difficult because I didn’t have sufficient financial capacity to get anything I wanted,” explained Vestine of her situation before joining her farmers’ group and engaging in group savings. She grew just enough potatoes to feed her family, she said, and struggled to pay for other essentials. “Some of my children were going to school, but it was very difficult to get their school fees and scholastic materials like exercise books and pens. I barely had the capacity to meet the family needs.”

Across rural, low-income communities, people report significant worry about how to pay for basic expenses like school fees and medical care in the event of illness. In 2024, the World Bank’s Global Findex Database found that just 56 percent of adults globally reported they could raise emergency funds within a month.

Financial vulnerability at this level can make it nearly impossible to invest in a better future, and this is the unrelenting paradox of rural farmers around the world: When you are living and working in poverty, you don’t have the money to lift yourself out of it.

“Coming together as women, saving together and borrowing to expand our economic activities or solve other problems was the basis for a transformational journey.”

— Vestine Icyimanizanye

Access to savings creates a safety net for rural farmers — but it can also be a pathway to prosperity. For those building livelihoods, a bank account can make it possible to send and receive payments and connect with other formal financial services, such as loans and insurance, that enable them to grow businesses and better support their families.

Where access to formal banking is limited or understanding of financial services is low, savings and loans at the community level, like the savings-and-loan function of Vestine’s farmers’ group, can be the start of this life-changing journey.

“There was a tremendous change [in] the way I started looking at different aspects of life,” Vestine said of joining together with other women. “Working in a group is important because you are able to borrow from the group, which is very important compared to working as an individual.”

Collaborating and saving as a group allows the women to build trust and harness their collective potential, each woman’s contribution being multiplied by 30. With a group-powered savings-and-loan fund to draw from, the women can worry less about meeting their children’s basic needs and pursue new income-generating opportunities in a way they couldn’t do alone.

“Joining the group has helped women in the group gain self-confidence,” Vestine explained.

A core component of Heifer’s work around the world is helping women form farmers’ cooperatives and self-help groups, like Vestine’s, through which they can participate in training, partner in business and establish savings-and-loan agreements to support one another’s ambitions. The impact of this is long-lasting, far-reaching and global: When women have access to savings and income, they are more likely than men to invest in education, health care and nutritious food for their families.

Through the Abihuje group, Vestine received training on good agricultural practices and financial literacy, including how to budget, save and track expenses. With this knowledge and the assurance of the group behind her, she took — and repaid — the loans that enabled her to transform her life, purchasing a cow to provide milk, supplies to grow more crops for income and building materials to construct a new house for herself and her four children. For the women, this is just the beginning: Five of the members have now opened bank accounts to formally save and borrow on behalf of the group, giving each of the women more purchasing power to buy what they need to build strong futures.

“The situation [from] before joining the group has changed,” Vestine said. “My children are able to get clothes, school materials and we eat well at home without difficulty. It feels good.”

Cart is empty

Success!

Please be patient while we send you to a confirmation page.

We are unable to process your request. Please try again, or view common solutions on our help page. You can also contact our Donor Services team at 855.9HUNGER (855.948.6437).

Covering the transaction fee helps offset processing and administrative fees that we incur through taking payments online. Covering the transaction fee for each payment helps offset processing and administrative fees that we incur through taking payments online. Covering the transaction fee for each payment helps offset processing and administrative fees that we incur through taking payments online.