Financial Information

Supporting Sustained Growth

Heifer International reports audited financial statements, annual reports and tax information, including our nonprofit status and the IRS Form 990.

Trusted as a results-driven partner

We believe that ending hunger and poverty begins by developing long-term solutions in partnership with the people we’re serving. Through this work, we’ve helped empower more than 52.6 million families since 1944.

We believe that ending hunger and poverty begins by developing long-term solutions in partnership with the people we’re serving. Through this work, we’ve helped empower more than 52.6 million families since 1944.

When communities and other stakeholders are actively engaged in implementation and financing, projects are more sustainable. This enables us to work on a deeper level, fostering economic markets that allow family members to earn a living income, so the basic needs of everyone in the household are met.

We have seen results in transforming the level of transparency, accountability, and innovation in the nonprofit world through blockchain technology. Our School Milk Program in Tanzania is providing milk for children who suffer from a lack of proper nutrition while creating a reliable market for producers. Through Hatching Hope, our partnership with Cargill is allowing farmers to expand poultry production and sell their products at market for a living income.

We are committed to running an efficient and effective organization. We believe values-based partnerships and investments are necessary for long-term growth.

Nonprofit tax status

Heifer International is a nonprofit organization and contributions are tax-deductible under U.S. tax regulations. Heifer is exempt from federal income taxes under Section 501(c)(3) of the Internal Revenue Code.

What percent of Heifer International donations go to charity?

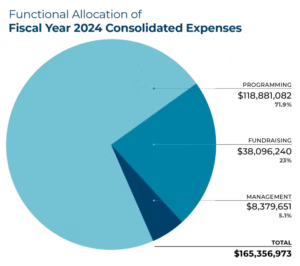

In fiscal year 2024, 71.9% of Heifer International’s expenses went to programming. That means more than 70% of Heifer’s expenses were spent helping people around the world move from poverty to power. The remaining spending went to fundraising (23%) and management (5.1%). In dollars, that’s a total of $165,356,973 spent, with

In fiscal year 2024, 71.9% of Heifer International’s expenses went to programming. That means more than 70% of Heifer’s expenses were spent helping people around the world move from poverty to power. The remaining spending went to fundraising (23%) and management (5.1%). In dollars, that’s a total of $165,356,973 spent, with

- $118,881,082 going to programming

- $38,096,240 going to fundraising

- $8,379,651 going to management

Heifer exceeds the Better Business Bureau standard for charities. The Better Business Bureau standard for fundraising is 65% for program expenses and 35% for fundraising, and Heifer International’s operations are 71.9% for program expenses and 23% for fundraising.

We regularly assess the effectiveness of our costs in comparison to fundraising success and work to direct as much funding to programs as possible while still raising the funds necessary to make the work happen.

Read our annual report for more information.

Consolidated audited financial statements

Download the Consolidated Financial Statement for Fiscal Year ending June 30, 2024.

Annual reports

Below are Heifer International’s annual reports in PDF format.

IRS form 990

The annual IRS Form 990 is a public document that provides useful information for the IRS and the public so they may evaluate nonprofits and how they operate. The IRS uses it to assess exempt status and other activities, including finances, governance, compensation paid to certain persons and compliance with certain federal tax filings.

Though it doesn’t take into account the growth investments necessary to scale up our programs, we’ve made our Form 990 available online so you can see just how cost-effective our programs are.

View the current and past years’ IRS Form 990 below in PDF format.

Accountability and Transparency

Accountability is a core component of Heifer International. In addition to our annual report, audited financial statements and the IRS Form 990, we also provide the following information in the spirit of transparency.

- Conflict of Interest Policy

- Global Whistleblower Policy To anonymously submit a question or report a concern about Heifer’s work, visit our compliance reporting site here.

- Information and Document Retention and Destruction Policy

- Executive Compensation Process

Related Information

Heifer International Statement on Foreign Assistance Funding Trends, April 20, 2025